Which Best Describes a Sole Proprietorship

A sole proprietorship is a business owned by the individual not the business. C A business in which two persons agree to run a single business together d A business with more than one owner in which each partner is fully and individually responsible for any liabilities incurred by the company.

Memorandum Of Association Contents Clauses Alternation Memorandum Association Content

The legal characteristics of.

. The sole proprietorship is the simplest kind of business to operate. C The sole proprietor owns all of the business and has the right to receive all of the businesss profits. A business that legally has no separate existence from its owner.

Which of the following best describes a sole proprietorship. In other words the business is one and the same as the owner. A sole proprietor has full control Why is liability disadvantage of sole proprietorship.

Corporations are distinguished from their shareholders as legal entities. In a sole proprietorship only the owner of the business is liable for its debts and obligations. Which Best Describes A Sole Proprietorship.

Which best describes a sole proprietorship. D A criminal law firm with multiple senior partners. It is the simplest legal form of a business entity.

Click card to see definition. A man who owns and operates a lawn mower repair business by himself. A business with a single owner who is responsible for all debts but individually controls all profits.

Sole proprietorships are the most common form of business organization in the United States. The sole proprietorship is the simplest business form under which one can operate a business. Which of the following is the main 1.

A sole proprietorship also known as individual entrepreneurship sole trader or simply proprietorship is a type of unincorporated entity that is owned by one individual only. Corporation A corporation is a legal entity created by individuals stockholders or shareholders. The sole proprietorship is not a.

Quarterfreelp and 13 more users found this answer helpful. Sole proprietorships do not have to pay employment taxes. It is the preferred form of business ownership because of its simplicity O b.

The sole proprietorship is the most common form of legal structure for small businesses. A sole proprietorship is a type of business entity thats run and owned by a single person. A Forming a sole proprietorship is easy and does not cost a lot.

MCQs on Sole Proprietorship. Which of the following is the main disadvantage of forming a general partnership. Sole Proprietorship A sole proprietorship is a type of business entity that is owned and run by one individual and in which there is no legal distinction between the owner and the business.

It refers to a business owner. Which of the following best describes sole proprietorships. Two or more people carrying on an unincorporated.

The sole proprietor of a business is protected from liability for debts of the business if the assets of the business are kept separate from personal assets O c. One owner of a sole proprietorship pays income tax on the profits earned by the business since the business is not incorporatedIn addition to their ease of starting up and dismantling sole proprietorships are popular with small business owners and contractors because government involvement is minimal. Corporations are classified as persons by the Internal Revenue Service.

Income and losses are taxed on the individuals personal income tax return. Sole proprietorships generate about 40 percent of all sales in the United States. There is no legal distinction between the individual and the business every asset belongs to the owner.

Risks and rewards are generally shared proportionately to ownership. Note that unlike the partnerships or corporations. B The owner has the right to make all management decisions concerning the business including those involving hiring and firing employees.

A sole proprietor cannot be dissolved or sold to another person. Lastly a partnership is a joining of individuals in which the partners share profits or losses. A business owned by an individual Which advantage of a sole proprietorship could also be a disadvantage.

Difference Between Sole Proprietorship and Partnership. For this option there is no legal distinction between the business and the owner. The owner could lose personal property if.

Sole proprietorships can be owned by more than one person. Partnerships involve at least two people who pool sources for the business and share profits and losses. Sole proprietorship has a single owner while partnerships has two or more owners.

Profit And Loss Statement For Self Employed Template Business Balance Sheet Template Balance Sheet Statement Template

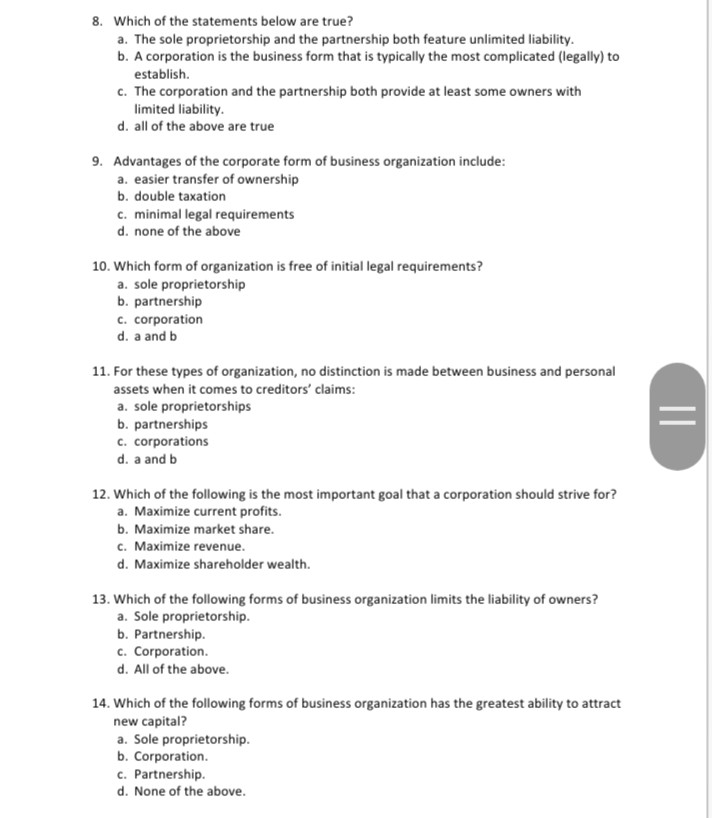

Fin 370 Final Exam 54 Questions With Answers The New Exam 1st Set Buy This One 30 Off Exam Final Exams Finals

Balance Sheet With Financial Ratios Templates Balance Sheet Template Balance Sheet Resume Template Examples

Phi 208 Week 4 Quiz New 2016 1 Aristotle States That If We Ask What The Highest Good Is 2 Aristotle Describes Each Vi Environmental Ethics Quiz Kevin Kline

Simple Marketing Plan Outline Marketing Plan Outline Small Business Plan Template Marketing Plan

Rera Complaint An Overview Service Level Agreement Cooperative Society Legal Services

Business Cycle Poster Project Macroeconomy Policymaking And The Business Cycle Google Classroom Activities Google Classroom Assignments Economic Research

Latinotype New Home Informative Myfonts Download Fonts

Res 341 Week 3 Statistical Symbols And Definitions Matching Assignment 30 Off Statistical Chi Square Null Hypothesis

14 Method Statement Templates Download Free Formats In Word Pdf Statement Template Free Resume Samples Method

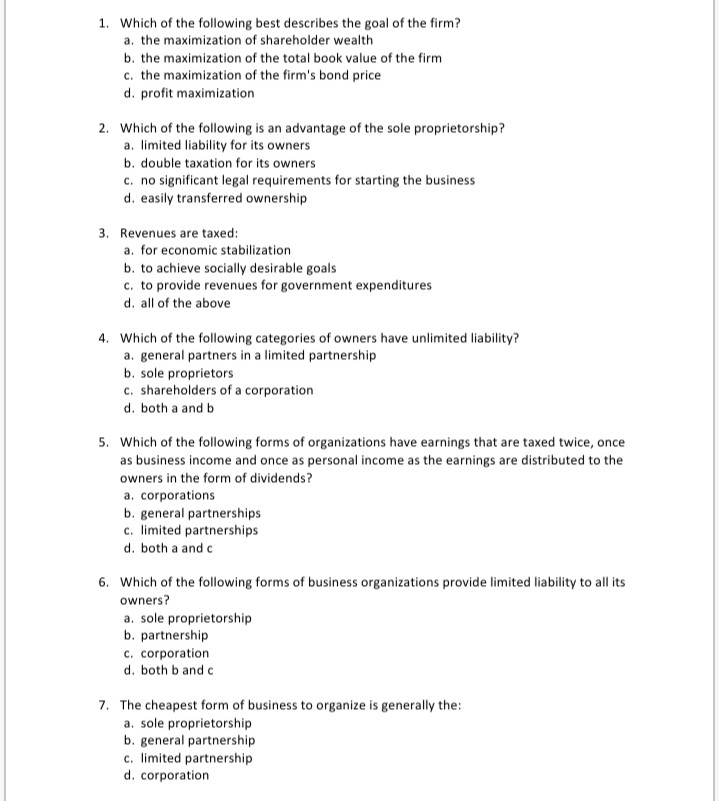

Solved 1 Which Of The Following Best Describes The Goal Of Chegg Com

Business Plan Outline Template Free New Business Plan Outline Template 12 Download Fre Simple Business Plan Template Basic Business Plan One Page Business Plan

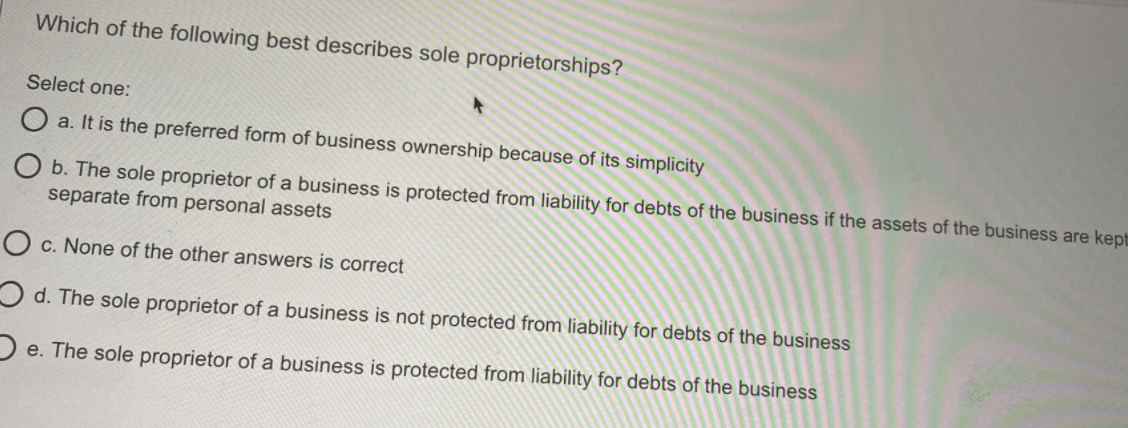

Solved Which Of The Following Best Describes Sole Chegg Com

Bus 210 Week 2 Knowledge Check Limited Liability Company Knowledge Liability

Solved 1 Which Of The Following Best Describes The Goal Of Chegg Com

6 Essential Forex Trading Tools Do You Have A High Probability Entry Tool Then Read More Forex Perfect Entry Best Forex Entry S Forex Trading Forex Trading

This Article Describes The Singapore Company Law Regarding The Requirements And Procedures For Registeri Private Limited Company Limited Company Corporate Bank

Balance Sheet Templates 15 Free Docs Xlsx Pdf Balance Sheet Template Balance Sheet Employee Handbook

Comments

Post a Comment